Straight line method formula

Therefore an equal amount of depreciation is charged every. The salvage value of asset 1 is 5000 and of asset 2 is 10000.

Equations Of Straight Lines Linear Functions Math For Kids Math Lessons Fun Math

Depreciation Expense Cost Salvage ValueUseful life.

. Where Book value of. Example of Straight Line Depreciation Method. Straight line depreciation cost of the asset estimated salvage value estimated useful life of an asset.

Straight Line Method SLM According to the Straight line method the cost of the asset is written off equally during its useful life. Applied to this example annual depreciation would be. This method assumes that the.

Using the straight-line method of amortization. The straight-line method of amortization typically applies to bonds but it can also be used to figure out mortgage repayments. Straight Line Method of Depreciation - Example.

Company ABC purchases new machinery cost 100000 on 01. Straight line equation using two-point forms. The straight-line method of depreciation attempts to allocate equal portion of depreciable cost to each period of the assets useful life.

Lets say Spivey Company uses the straight-line method for. The more elaborated explanation of the point-slope method of the equation of a line is the two-point method of a line equation. Has purchased 2 assets costing 500000 and 700000.

Learn how and when to use this formula. The formula for calculating depreciation under the straight-line method is. As stated above the straight line method is dependent entirely on an assets acquisition cost the cost of the asset with which the asset.

In year one you multiply the cost or beginning book value by 50. Book value residual value X depreciation rate. Depreciation Expense Cost Salvage Useful Life.

Cost of Asset is. The formula for the straight-line depreciation method is quite straightforward to calculate. The formula for calculating straight line depreciation is.

The DDB rate of depreciation is twice the straight-line method. The formula to calculate annual depreciation using the straight-line method is cost salvage value useful life. Straight-line depreciation is a method used to calculate the decline in value of fixed assets such as vehicles or office equipment.

Lets take a simple example to understand how the straight-line depreciation works Ajay blade works purchased a machine. Straight Line Method of Depreciation Formula. You then find the year-one.

Youtube Method Class Explained

Journal Entry For Depreciation Accounting Notes Accounting Principles Journal Entries

Declining Balance Depreciation Calculator Double Entry Bookkeeping Calculator Bookkeeping Accounting And Finance

Methods Of Depreciation Learn Accounting Method Accounting And Finance

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Profitability Index Pi Or Benefit Cost Ratio Money Concepts Investing Budgeting

Calculate Depreciation In Excel With Sln Straight Line Method By Learnin Learning Centers Excel Tutorials Excel

The Simplest And Most Commonly Used Method Straight Line Depreciation Is Calculated By Taking The Purchase Or Acquisitio Business Valuation Method Subtraction

Straight Line Depreciation Calculator With Printable Schedule Best Money Saving Tips Family Money Advertising Costs

Depreciation Journal Entry Step By Step Examples Journal Entries Accounting Basics Accounting And Finance

Illustrates How The Slope Formula Is Used To Find The Slope Of The Line Passing Through A Given Two Points Or Ordered Slope Formula Studying Math Math Lessons

How To Solve Linear Equations In One Variable By Trial And Error Method Solving Linear Equations Linear Equations Equations

Depreciation Bookkeeping Business Accounting Education Accounting Basics

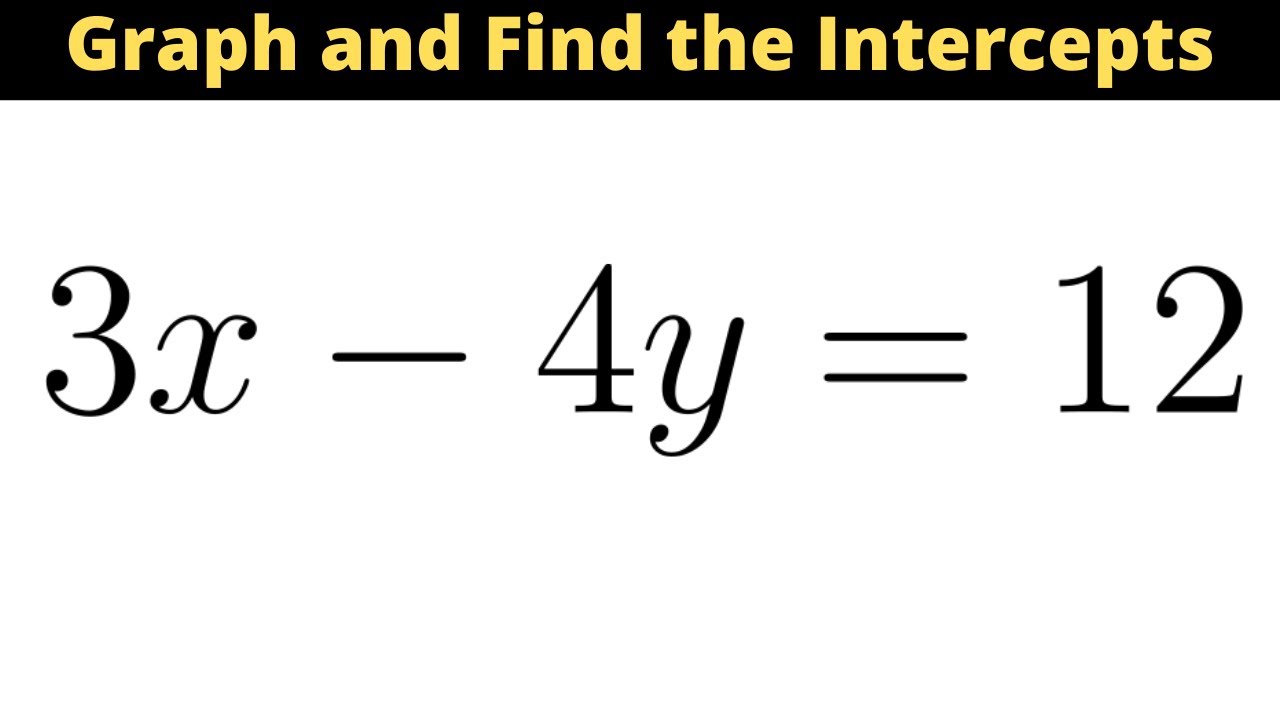

Graph The Equation Of The Line 3x 4y 12 And Find The X And Y Intercepts Graphing Math Videos Equation

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

Accelerated Depreciation Method Accounting And Finance Accounting Basics Accounting Education

The Book Value Per Share Formula Is Used To Calculate The Per Share Value Of A Company Based On Its Equity Available To Co Book Value Business Valuation Shared